Request a Catalog

Enter for a chance to win a stool just by clicking the above Icon and requesting to receive our catalog.

Tax Credit

Learn how to receive up to $5000 back on your tax returns through purchasing one of these amaing tables.

Color Chart

We offer 48 pad colors to match your room color or to enhance the look of your settings.

Table Shapes

Select one of our several table top shapes created from years of designing massage table tops for all types of modalities.

Want to take a ride? Here's where we will be next.

Tax Credit

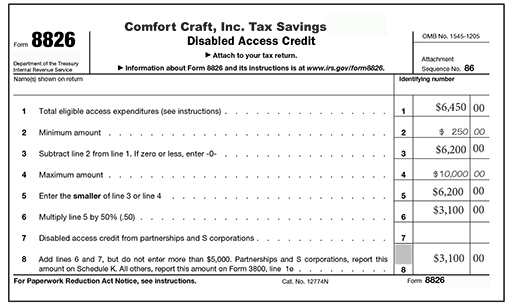

Step 1 - How to Use IRS Tax Form 8826

| Package Price | $6,450 | |

| Minimum amount for tax credit | -$ 250 | |

| $6,200 | ||

| Divided by 50% = | $3,100 |

Step 2 - How the Normal Equipment Write-Off Works

| Package Price | $6,450 | |

| Minimum Direct Credit (above) | $3,100 | |

| Multiply Your Tax Rate 28%* = | x .28 | |

| Equipment Write-Off Amount from section 179 | $938 | |

| *28% tax rate used as an example. Rates may vary from 15% to 38% based on your tax bracket. |

Step 3 - Calculate Your Total Tax Relief

| Add Direct Credit sec 44 (step 1) | $3,100 | |

| Plus Equipment Write-Off sec 178 (step 2) | +$938 | |

| Total Tax Relief | $4,038 |

Step 4 - Subtract Your Total Tax Relief from Original Sale Price

| Original Package Price | $6,450 | |

| Total Tax Relief | $4,038 | |

| Your Cost of Model 800 STP Package after Tax Relief (not including shipping cost) |

$2,412 |

This credit is available according to Section 44 of the Internal Revenue Code. To qualify, the profesional's practice must meet the following requirements: 1) Annual Gross reciepts of the practice do not exceed $1,000,000 or 2) the practice employs no more that 30 full time employees during the taxable year in which the credit is elected. 3) The equipment cannot cost less than $250 and cannot cost over $10,250.

Remember to consult your tax advisor to make sure you qualify